MP Board Class 12th Economics Important Questions Unit 10 Balance of Payments

Balance of Payments Important Questions

Balance of Payments Objective Type Questions

Question 1.

Choose the correct answers:

Question 1.

Structure of balance of payment includes which account:

(a) Current account

(b) Capital account

(c) Both (a) and (b)

(d) None of these.

Answer:

(c) Both (a) and (b)

Question 2.

Balance of trade means :

(a) Capital transactions

(b)Import and export of goods,

(c) Total credit and debit

(d) All of the above.

Answer:

(b)Import and export of goods,

Question 3.

Measures to improve adverse balance of payment includes :

(a) Currency devaluation

(b) Import substitution

(c) Exchange control

(d) All of the above.

Answer:

(d) All of the above.

![]()

Question 4.

Foreign Exchange Rate is determined by :

(a) Demand of foreign currency

(b) Supply of foreign currency

(c) Demand and supply in foreign exchange market

(d) None of these.

Answer:

(c) Demand and supply in foreign exchange market

Question 5.

Types of Foreign Exchange Market are :

(a) Spot market

(b) Forward market

(c) Both (a) and (b)

(d) None of these.

Answer:

(c) Both (a) and (b)

Question 2.

Fill in the blanks:

- Bretton woods system is also known as ………………… border system.

- There is ………………… relation between foreign exchange rate and the supply of foreign exchange.

- By devaluation, the value of currency …………………

- ………………… items are included in the balance of trade.

- Balance of payment always remains …………………

- The value of currency of one country with that of the currency of another country is called …………………

Answer:

- Adaptable

- Direct

- Reduces

- Visible

- Balanced

- Exchange rate.

Question 3.

State true or false :

- Balance of trade includes both visible and invisible items.

- Balance of trade is a part of Balance of payments.

- Devaluation is declared by the government.

- Balance of payment is always balanced.

- For export promotion, help of devaluation is taken.

- The increasing population in developing countries has direct impact on economic growth.

- Export promotion is one of the ways of correcting Balance of payments.

Answer:

- False

- True

- True

- True

- True

- False

- False.

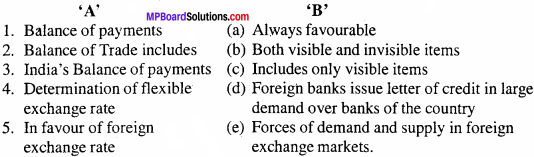

Question 4.

Match the following :

Answer:

- (b)

- (c)

- (a)

- (e)

- (d)

Question 5.

Answer the following one word/ sentence:

- New trade policy was declared in which year?

- What will be the effect of devaluation of Indian currency on Indian imports?

- In the long run, for what do the importers pay?

- What does capital account imply?

- What is the exchange of currency of one country in currency of another country called?

Answer:

- 1991

- Costly

- Exports

- International exchange and Indebtness

- Ex – change Rate.

Balance of Payments Very Short Answer Type Questions

Question 1.

What is Balance of Payment?

Answer:

The balance of payment of a nation consists of the payments made, within a particular period of time between the residents of the country and the residents of foreign countries.

Question 2.

What do you mean by foreign exchange rate?

Answer:

Meaning:

The rate at which one currency buys or exchanges another currency is known as the rate of exchange. It simply expresses its external value or purchasing power. Foreign exchange rate between the currency units of two countries means the number of units of one national currency that are needed to buy one unit of other national currency.

![]()

Question 3.

Differentiate between Balance of Trade and Balance of Payment.

Answer:

Difference between Balance of Trade and Balance of Payment:

Balance of Trade:

The difference between exports and imports is called balance of trade.

Balance of Payment:

The difference between the total receipts of foreign exchange and total payment of foreign exchange is called balance of payment.

Question 4.

What do you mean by unfavourable balance of payment? Explain.

Answer:

Unfavourable balance of payment:

It is also called the deficit balance of payment. It refers to the situation when the total liability for payments of a nation exceeds the total receipts from foreign countries. Hence certain additional transactions are necessary to balance it such as export of gold, withdrawal of deposits in foreign banks etc.

Question 5.

What do you mean by capital account?

Answer:

Capital account is that account of balance of payment which records all such transactions between the residents of a country and rest of the world which cause a change in asset or liability of the country.

Question 6.

What do you mean by current account of balance of payment?

Answer:

Current account is that account of balance of payment which records imports and exports of goods and services and unilateral transfers. It includes visible, invisible and unilateral transfers.

Question 7.

What do you mean by managed floating system?

Answer:

Managed floating system is a mixture of flexible exchange rate system and fixed rate system. (The float part + managed part). Under this system the central bank tend to intervene to buy and sell foreign currencies in an attempt to reduce fluctuation in exchange rate.

Question 8.

What do you mean by protection?

Answer:

When by ending the freedom of foreign trade the ban is put on import and export of goods it is called protection.

Question 9.

Write one advantage of open economy?

Answer:

Investors get the choice of selection among domestic products and foreign goods.

Question 10.

What do you mean by dumping?

Answer:

When the goods are excess than demand then the seller sells this goods in foreign countries on lower rate it is called dumping.

Question 11.

Write points in favour of fixed exchange rate.

Answer:

- To encourage international trade.

- Formation of capital.

- Encouragement to foreign capital

- Encouragement to export countries.

Question 12.

What do you mean by foreign trade multiplier?

Answer:

Foreign exchange rate multiplier tells us how many times increase takes place in national income by increasing in export.

Question 13.

What does a balance of payment record?

Answer:

The balance of payment records the transaction in goods and services and assets between residents of a country with the rest of the world.

Question 14.

What is dirty floating?

Answer:

When managed floating in the absence of rules and guidelines are implemented, it is called dirty managed floating system.

Question 15.

What do you mean by import and export?

Answer:

Import:

When goods and services are brought from the foreign countries to the domestic countries it is called import.

Export:

Goods and services are send to foreign countries from domestic countries.

![]()

Question 16.

What does foreign exchange market include?

Answer:

Foreign exchange market includes banks specialised foreign exchange dealers, brokers, government agencies through which the currency of one country can be exchanged for that of other country.

Question 17.

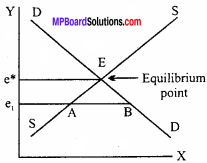

What do you mean by flexible exchange rate?

Answer:

Flexible rate of exchange:

It is freely determined by the prices of supply and demand in the internal market.

Question 18.

What do you understand by managed floating rate system?

Answer:

It is a hybrid of a fixed exchange rate and flexible exchange rate system. In this system, central bank intervenes in the foreign exchange market to restrict the fluctuations in the exchange rate within certain limits. The aim is to keep exchange rate close to desired target values.

Question 19.

Give arguments in favour of fixed exchange rate.

Answer:

Following points can be studied in favour of fixed exchange rate:

- Encouragement to international trade.

- Encouragement to foreign capital.

- Capital formation.

Question 20.

Write points against fixed exchange rate.

Answer:

Following are the points against fixed exchange rate :

- Controlled economy.

- Encouragement to corruption.

- Sudden change in exchange rate.

- Unfavourable effect on economic development.

Question 21.

Explain two merits and two demerits of fixed foreign exchange rate.

Answer:

(a) Two merits of fixed foreign exchange rate :

- Fixed foreign exchange rate ensures stability in exchange rate. The exporters and importers do not have to operate under uncertainty about the exchange rate. Thus, it promotes foreign trade.

- It also promotes capital movements.

(b) Two demerits of fixed foreign exchange rate :

- Under this system, countries with deficit in balance of payment run down the stock of gold and foreign currencies. This can create serious problem for them.

- There may be undervaluation of currency.

Question 22.

Write down the advantages of fixed exchange rate system.

Answer:

Advantages of fixed exchange rate system :

- This system ensures stability in the international money market/ exchange market.

- It encourages international trade.

- It promotes bilateral trade agreements.

- It avoids speculation.

- It keeps the government under pressure to combat inflation.

Balance of Payments Short Answer Type Questions

Question 1.

What do you mean by fixed exchange rate? Write three points against it.

Answer:

A fixed exchange rate is a regime applied by a country whereby the government or central bank ties the official exchange rate to another country’s currency or the price of gold. The purpose of a fixed exchange rate system is to keep a currency’s value within a narrow band.

Following are the different points against the fixed exchange rate:

1. Controlled economic system:

For fixed rate of exchange it is compulsory to have strict control over economic system. If it is not possible then we will have to make changes in exchange rate.

2. Unfavourable effect on economic progress :

The main aim of fixed rate of exchange is to maintain stability in exchange rate. In this situation sometimes national income, employment policy, price level etc. are considered as secondary.

3. Corruption:

To maintain fixed exchange rate many restrictions are imposed in the country. Due to strict restrictions there is always possibility of corruption in the society.

4. Sudden change in the exchange rate:

Some times it becomes evitable to make changes in exchange rate. To keep the exchange rate stable some times currency of the nation becomes weak. In such stuation sometimes the there is devaluation. It has adverse effect on foreign trade and balance of payment.

Question 2.

What is meant by flexible exchange rate? Give arguments in favour and against flexible exchange rate.

Answer:

A system in which rate of exchange is determined by the sources of demand and supply of different currencies in foreign exchange market.

Following points which can be studied in favour of flexible exchange rate :

1. Independent economic policy : If the exchange rates are elastic any country can make their domestic economic policies internal policies) independently.

2. Implementation of monetary policy independently : If the rate of exchange is flexible monetary policy in the nation can be independently and effectively by changing the monetary policy.

Following points which can be studied against the flexible exchange rate :

1. Adverse economic effect:

If the flexible exchange rate is there then the feeling of insecurity comes in the minds of traders. It has an adverse effect on the foreign trade of the country. The tendency of gambling increases. If the exchange rate is reduced the inflation increases. The level of employment opportunities also go down.

2. Misuse of the resouroes:

If exchange rate goes on changing very often then the resources have to distributed again and again sometimes the resources are used in export sometimes for domestic industries. Due to these changes there is always wastage of resources.

![]()

Question 3.

What do you mean by balance of payment? What are the causes of adverse balance payment in India?

Or

Explain four causes of adverse balance of payment.

Answer:

Meaning of balance of payment:

The balance of payment of a nation consists of the payments made, within a particular period of time between the residents of the country and the residents of foreign countries.

Following are the causes of adverse balance of payment in India:

1. Increase in imports of petroleum products:

Oil producing countries are increasing the price of petroleum products every year. Along with it the consumption of petroleum products is also increasing day by day. Due to this import is done on lkrge scale.

2. Increase in import of machines:

Due to economic planning there is rapid growth in industrialization and progress in agricultural development. For this the need of machines was felt. Due to this reason more import has to be done.

3. Less increase in export:

The export did not increase according to expectations which is one of the causes of unfavourable balance of payment.

4. International loans and investment:

India has taken loan for developmental purpose. To repay the principal amount and interest, foreign exchange has to be paid. It gave rise to the situation of adverse balance of payment.

Question 4.

Suggest measures to improve the condition of adverse balance of payment

Answer:

Measures or method to correct adverse balance of payment : Following steps should be taken to improve adverse balance of payment in India :

1. Encouragement to export:

The government should encourage the export.

- The trade policy should be export oriented

- For this export tax should be reduced or some concession should be given for export of some goods

- Economic assistance should be provided to the industries of the country

- Advertisement should be done in foreign countries for the products.

2. Reduction in import:

India should reduce imports. For this import duty should be raised so, that imported goods will become expensive and people will be discouraged to purchase them. Domestic products should be discouraged reduce the imports. It will give rise to favourable balance of payment.

3. Foreign debt:

To remove adverse balance payment government can take foreign loan. But taking loan is a temporary solution of it.

4. Exchange control:

For keeping the balance payment exchange control is one method. By controlling exchange we can reduce import and increase export.

Question 5.

Give arguments in favour and against fixed exchange rate.

Or

Give arguments in favour of fixed exchange rate.

Answer:

Follo’wing are the points which can be studied in favour of fixed exchange rate :

1. Encouragement to international trade:

Under fixed exchange rate both importer and exporter know about the amount he has to pay and how much he will be getting. Thus in fixed exchange rate international trade develops in a balance way. Here there is less risk.

2. Encouragement to foreign capital:

If the exchange rate is stable foreign exchange can easily flow into the country because investor is not scared of getting less amount than what is fixed. There is no fear of bearing of loss if the rate of exchange is reduced.

3. Capital formation:

If the foreign exchange rate is fixed there is a favourable effect on internal condition of the country. There is no fear of inflation. In industry demand of capital is increased, savings is also increased. Thus rate of capital formation increases. It gives rise to the development of the country.

4. Exchange system:

If the exchange rate is fixed it does not give encouragement to the tendency of gambling. Thus government can control the exchange system in proper way.

5. Essential for export countries:

Some of the country depend on the income coming from export. Half the national income of such countries comes from exports. For countries like England, Denmark, Japan etc. fixed rate of exchange is very essential otherwise there will be adverse effect on its development.

Following points are there against the fixed rate of exchange :

1. Controlled economic system:

For fixed rate of exchange it is compulsory to have strict controlled over economic system. If it is not possible then we will have to make changes in exchange rate.

2. Unfavourable effect on economic progress:

The main aim of fixed rate of exchange is to maintain stability in exchange rate. In this situation sometimes national income, employment policy, price level etc. are considered as secondary.

3. Corruption:

To maintain fixed exchange rate many restriction are imposed in the country. Due to strict restriction there is always possibility of corruption in the society.

Question 6.

Differentiate between Balance of Trade and Balance of Payment.

Answer:

Differences between Balance of Trade and Balance of Payment:

Balance of Trade:

- The difference between exports and imports is called balance of trade.

- It refers to detailed description of imports and exports only.

- It includes visible items only.

- It may be favourable and unfavourable.

- If balance of trade is not favourable it is not a cause of great concern.

- Balance of trade is a part of balance payment.

Balance of Payment:

- The difference between the total receipts of foreign exchange and total payment of foreign exchange is called balance of payment.

- It comprises not only exports and imports but also services, capital, gold etc.

- It includes visible as well as invisible items both.

- It is always balanced.

- If the balance of payment is not favourable it is a cause of great concern for the nation.

- The concept of balance of payment is broader.

Question 7.

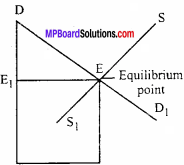

Differentiate between devaluation and depreciation.

Answer:

Differences between devaluation and depreciation:

Devaluation means lowering the value of one’s currency in terms of foreign currency. In this case, the domestic value of currency remains constant but its value in terms of foreign currencies fall. On the other hand, the fall in the price of foreign exchange under flexible exchange rate is known . as depreciation. For instance, if the equilibrium rupee – dollar exchange rate was Rs. 45 and now it has become Rs.50 due to rise in demand for dollars, then the rupee has depreciated against dollar.

![]()

Question 8.

What is the marginal propensity to import when M = 60 + 0.06Y? What is the relationship between the marginal propensity to import and the aggregate demand function?

Answer:

M = 60 + 0.6Y (Given)

M = \(\overline { m } \) + mY

Hence, m = 0.6

Where, m = Marginal propensity to import

Relationship:

There is positive relationship between marginal propensity to import and aggregate demand function. Marginal propensity of income spent. Thus,

m = \(\frac {∆m}{∆n}\)

Question 9.

Explain, why:

G -T = (Sg -1) – (X – M)?

Answer:

G -T = (Sf -1) – (X – M)

Here, G = Government expenditure

T = Taxes

Sg = Saving of government

I – Investment

Sg-I = Net Saving

X = Exporters

M = Importers

X – M = Balance of trade.

The given equation states that net government expenditure equals net government savings and balance of trade. It implies that net government expenditure is financed by government savings and trade deficit. Hence, the given equation is correct.

Question 10.

Should a current account deficit be a cause for alarm? Explain.

Answer:

When a country runs a current account deficit, then he must see whether there has been a decrease in saving, increase in investment or an increase in the budget deficit. There is reason to worry about a country’s long prospects of the trade deficit reflects smaller savings or a larger budget deficit. The deficit could reflect higher private or government consumption. In such cases, the country’s capital stock will not rise rapidly enough to yield enough growth it needs to repay its debt. There is less cause to worry, if the trade deficit reflects a rise in investment, which would build the capital stock more quickly and increase future output.

Question 11.

Distinguish between Balance of Trade and Balance on Current Account.

Answer:

Differences between Balance of Trade and Balance on Current Account:

Balance of Trade Account:

- Balance of trade account records the difference between value of imports and exports of material goods (visible items). lateral transfer (visible and invisible)

- Balance of trade is a part of balance on current account. So, it is a narrow concept.

Balance on Current Account:

- Balance on current account records the difference between receipts and payments of foreign exchange on account of goods, services and uni – items).

- Balance on current account is a wide concept.

Question 12.

If inflation is higher in country A than in country B and the exchange rate between the two countries is fixed, what is likely to happen to the trade balance between two countries ?

Answer:

Effect of inflation on the trade balance:

As the inflation is higher in country A than country B, so the prices of country A will be higher as compared to those of country B. In this case exports of A country will fail. The aggregate demand will fall and output and income will fall. Comparatively less price in country B will make its products less expensive and hence again increases w.e.f. net export and domestic output and income. The trade balance of country A will become deficit.

Balance of Payments Long Answer Type Questions

Question 1.

Write the components of Balance of payment.

Answer:

The Balance of payment of a nation consist of the payments made, within a particular period of time between the residents of that country and the residents of foreign countries. (MPBoardSolutions.com) In other words, it is an account of transactions involving receipts from foreigners on one side and payments to foreigners on the other side. The farmer relates to the international income of a country, they are called “credits” and since the later relates to the international out go, they are call “debits”.

Balance of payment includes all other payments apart from export and import. For example fee of banks, interest, profit, transfer of capital etc. are also included in balance of payment.

Question 2.

Write the main components of capital accounts.

Answer:

The main components of capital accounts are :

1. Borrowings and lending to and from abroad: It includes :

All transactions relating to borrowings from abroad by private sectors, government, etc.

All transactions of lending to abroad by private sectors and government.

2. Investment to and from abroad:

Investments by rest of the world in shares of

Indian companies, real estate in India etc.

Investments by Indian residents in shares of foreign companies, real estate abroad, etc.

3. Change in foreign exchange reserves:

The foreign exchange reserves are the financial assets of the government held in the central bank.

![]()

Question 3.

Explain the factors affecting fluctuations in foreign exchange.

Answer:

The factors affecting fluctuations in foreign exchange :

1. Banking related effects:

Banks through their functions affect the exchange rate. If the commercial bank float bank draft and other credit letters in large quantity then the demand for foreign exchange increases and the exchange rate of the country currency decreases. On the other hand, when foreign exchange bank floats credit letters against the country then the demand for home currency increases and the exchange rate becomes favourable for the country.

2. Change in prices:

In comparative view the change in prices results in the change of exchange rate of the country.

3. Impact of imports and exports:

Changes in the import and export quantity of country has a direct impact on the countries exchange rate if export increases in comparison to import the demand for foreign exchange. (MPBoardSolutions.com) If exports increase in comparison to imports the demand for foreign exchange increases and the countries exchange rate becomes favourable. But on the other hand if imports increase then the demand for country currency increases in the foreign country and this becomes unfavourable for the country.

4. Impact of speculation:

The changing trend in speculation trends also have an impact on exchange rate. In short period the.high rate of exchange leads to speculation tendencies. The uncertainty of exchange rate in international money market also encourages speculative motive.

5. Flow of capital:

The flow of capital from a country also affects the exchange rate. Flow of capital from one country to another to earn high profits is possible in short period or flow of capital to foreign countries for investment in the long period in the foreign country is also possible.

Question 4.

Explain visible and invisible export and import.

Answer:

Visible Import and Exports:

Such goods are included in visible imports and exports whose account is maintained in the register of ports. By seeing them we can find out the values of import and export done throughout the year. (MPBoardSolutions.com) In it only the export and imports of goods are kept.

Invisible Import and Exports:

In invisible export and import we include services which exchange are included. They are banking services, insurance, shipping services, education in foreign, medical facilities, tourism, interest, profit, military assistance, foreign donation, penalty etc. whose account is not maintained on ports are included in it.

![]()

Question 5.

Suppose C =100 + 0.75Y, 0T = 500, G = 750, taxes are 20% of income. X = 150, M = 100 + 0.2Y. Calculate equilibrium income, the budget deficit or surplus and the trade deficit or surplus.

Answer:

C = 100 + 0.75 YD

Here, C = 100, C = 0.75, I = 500, G = 750, X = 150, M = 100 + 0.2Y

Tax income (r) = 20%

Income (Y) = C + C (1 – t) Y +1 + G + (X – M)

or Y = 100 + 0.75 (1 – 0.2)Y + 500 + 750 + (150 – 100 – 0.2Y)

or Y = 100 + 0.75(0.8) Y + 500 + 750 + 150 – 100 – 0.2Y

or Y= 100 + 0.6Y+ 1300 – 0.2Y

or = 1400 + 0.4Y

or Y – 0.4 Y = 1400

or 0.6Y = 1400

or Y = \(\frac {1400}{0.6}\) = 2333

Deficit budget = Govt. expenditure Tax – (G) – Tax

= 750 – 2333 of 20 %

= 750 – 467 = 283

M = 100 + 0.2Y

= 100 + 0.2 (2333)

= 100 + 467 = 567

So, Trade deficit = M – X = 567 – 150 = 417.