MP Board Class 11th Accountancy Important Questions Chapter 17 Accounting in Non-trading Organizations

Accounting in Non-trading Organizations Important Questions

Accounting in Non-trading Organizations Objective Type Questions

Question 1.

Choose the correct answer:

Question 1.

Such persons who earn remuneration against their services are called –

(a) Seller

(b) Purchaser

(c) Professional

(d) None of these.

Answer:

(c) Professional

Question 2.

Which of the following is not an item of income of Non – trading concern –

(a) Entrance fees

(b) Interest

(c) Govt. Aid

(d) Salary.

Answer:

(d) Salary.

Question 3.

Receipt and payment account is a summary of –

(a) Income & Expenditure account

(b) Profit & Loss A/c

(c) Cash – book

(d) None of these.

Answer:

(c) Cash – book

![]()

Question 4.

Which of the following is recorded in income & expenditure account –

(a) Revenue items

(b) Capital items

(c) Revenue and capital items

(d) None of these.

Answer:

(a) Revenue items

Question 2.

Fill in the blanks:

- The main object of non – trading concerns is ……………….

- The debit side of income & expenditure A/c is called ………………. side.

- Non – trading concerns maintain their books according to ………………. system.

- ……………… account is prepared with the help of cash-book.

- Only …………… item are shown in income & expenditure A/c.

- …………….. represents the excess of assets over liabilities.

Answer:

- Social service

- Expenditure

- Cash

- Receipts & payment A/c

- Revenue

- Capital.

Question 3.

Match the following:

Answer:

1. (a)

2. (b)

3.(d)

4. (c)

5.(e).

Question 4.

Answer in one word / sentence:

- Which statement/Account reveals the financial position of the non – trading concerns?

- “The receipts and payments account is nothing as more than the summary of the cash book” who said this?

- When a donor provides a continuous source of income to the concerns by endowment of property or money, such a donation is called.

- What is the nature of interest on investments?

- The major source of non – trading concern is.

Answer:

- Balance sheet

- Pickles

- Endowment fund

- Revenue

- Subscription.

![]()

Question 5.

State True or False:

- Doctor employed with government is an example of non – trading professional.

- Professional people maintain their accounts according to cash system.

- Income & expenditure account reveals cash balance.

- Capital items are written in Receipts & payments account.

- No adjustment is made in Receipt & payment A/c.

Answer:

- False

- True

- False

- True

- True.

Accounting in Non-trading Organizations Short Answer Type Questions

Question 1.

What are the characteristics of receipts and payments Account?

Answer:

Characteristics of receipts and payments Accounts are:

- In this account all receipts and.payments are recorded related to different years.

- All items of capital and revenue nature are recorded in it.

- Only cash receipts and payments.are recorded in it.

- In this account, enter first of all the opening balance of cash and calculates the closing balance at the end.

- No adjustments are done in this account.

- It is a real account.

Question 2.

Write some characteristics of income and expenditure account.

Answer:

- It is Nominal Account.

- Only revenue receipts and payments are entered in it.

- It is prepared with the help of receipts and payments account.

- Opeing and closing cash balance is excluded from this account.

- All sorts of adjustments takes place in this account pertaining to income & expenses.

- Items of current year only are recorded in this account.

- The balance of this account reveals surplus or deficit.

Question 3.

“Receipts and payments account is a summary of cash – book.” Explain.

Answer:

Receipts and payments account does not show the economic status of non – trading concern because:

- In this account all the receipts are entered whether it is related to the past, current or coming year.

- No distinction is made for capital or revenue nature.

- From this account, it is not possible to find out details about the last year’s assets, liabilities and capital fund of the firm.

As per above given points we can say that receipts and payments accounts does not show the financial position of any concern. It is a summary of cash – book.

![]()

Question 4.

Explain the following:

- Capital fund

- Endowment fund

- Life membership fees

- Subscription

- Legacy

- Entrance fees.

Answer:

1. Capitaml fund:

For calculating capital fund, an opening balance sheet is prepared with the help of last year’s assets and liabilities. The total of liabilities side is deducted from the total of assets side and the difference thus gained is called capital fund.

Capital fund = Total assets – Total liabilities on opening date.

2. Endowment fund:

When endowment of a property or amount is made by a member or a non – member to the non-trading concern for specific purposes, it is called as an endowment fund. By endowment of property or money, the donor provides a continuous source of income to the concerns.

3. Life membership fee:

Some members may like to pay their membership fee in a lump sum single instalment for whole of the life. This lump sum payments on account of membership fee is called Life Membership Fee. The members who pay such lump sum fee are not required to pay annual fee for whole of the life. Such receipts is shown in the liability side of the balance sheet in a special fund and a proper portion equal to the normal annual subscription is transferred to the income and expenditure account every year till the fund amount is fully exhausted.

In some non – trading concerns the entire life membership fee is transferred to the capital fund in the year of its receipts. In the absence of any specific instructions whole of such fees be capitalized.

4. Subscription:

It is the main source of regular income of the non – trading concerns. The members pay subscription amount, monthly or annually to keep their membership continued. This item is shown in the income side of the account as a revenue receipts.

5. Legacies:

Legacies are the gifts received by the non – trading concerns as per the will of deceased members or non – members through their legal heirs. This is not a regular source of income.

6. Entrance fee:

At the time of giving membership, the non – trading concerns charge a specific amount as an entrance fee from the new members. This receipts is a non-recurring receipts since it is charged only once, i.e., at the time of admission of a member. Hence, entrance fee is shown in the balance sheet by increasing the capital fund.

However, in some non – trading concerns the entrance fee is regarded as revenue receipts and taken in the income side on the plea that such receipts is recurring in nature since new members are enrolled by every year. In the absence of any specific instructions the students may follow either practice by appending a note to this effect in their solution.

Question 5.

What is meant by “Non-trading concern”?

Answer:

There are many institutions in India whose object is not to earn profit but to render service to the society. For example libraries, literary clubs, School, Colleges, Medical and Engineering institutions recreation Clubs and Cultural Forum etc. The aim of these institutions is not to earn profit, hence these institutions are called non-trading concern.

![]()

Question 6.

What do you mean by receipts and payments A/c?

Answer:

The non – trading institutions and professionals prepare an account to know the financial position and cash balance of specific period. The receipts are recorded in its debit side and payments are recorded in credit side of this account. This account is known as receipt and payment A/c.

Question 7.

Describe any two books are kept in under cash system.

Answer:

The books which are kept under cash system are as follows:

- Cash – book : All the non – trading concern kept their cash transaction is chronological order.

- Income and Expenditure A/c : At the end of current financial year for knowing their financial position they are this book which called Income and Expenditure A/c.

Question 8.

What is specific donation fund?

Answer:

Donations:

There are two types of donation:

- General donation.

- Specific donation.

The general donations are not received for any specific purpose. Such donations are received as recurring income and are shown in the income side of the account. Certain donations may be received for some specific purposes such as for the construction of building, award of prizes, etc. Specific donations are treated as capital receipts and hence shown in the liability side of the balance sheet till the specific purpose of donation is served. Thus, in any case such donations should not be treated as income.

![]()

Question 9.

What do you mean by Income and Expenditure A/c?

Answer:

For calculating the actual profit & loss for current financial accounting year, it is calculated by excess of income over expenditure or excess of expenditure over income. So the non – trading concern are prepared income & expenditure A/c in place of profit & loss A/c because they are not involve in selling and purchasing of goods.

Question 10.

What do you mean by professional person?

Answer:

In our society there are some people or group of some people are not involve in any kind of sale or purchase of goods but they are providing services to society like Doctor, Teacher, Lawyer. They are called professional person.

Question 11.

Write some income and expenditure heads of non – trading concerns.

Answer:

- Income heads – Entrance fees, subscription, Donation, life membership fees, Interest, rent and entertainment.

- Expenditure heads – Wages and Salary, Rent & Tax, Electricity exp. Depreciation, Repairs, Renewals and Printing and Tax etc.

![]()

Question 12.

What do you mean by opening balance sheet?

Answer:

As we all know the aims of non – trading concern is to provide services to the society so they do not have any capital. They collect the savings of every year. So we can say the information of assets and liabilities in the beginning is called opening balance sheet.

Question 13.

Receipt and payment is not the indication of actual financial position. Explain.

Answer:

These are following reason for that:

- In this accounts all the receipt and payment are recorded wether they are related for current year or not.

- When we are recording transaction we do not think about capital and revenue items.

- It is only a summary of cash – book so we can say it is unable to show actual financial position.

Question 14.

Explain some limitation of receipt and payment A/c.

Answer:

Limitation of receipt and payment A/c are as follows:

- It will not record in current year income and expenditure.

- It is ignored outstanding and prepaid expenditure and income.

- It does not shows surplus or deficit.

- On receipt and payment nobody can able to make balance sheet.

Accounting in Non-trading Organizations Long Answer Type Questions

Question 1.

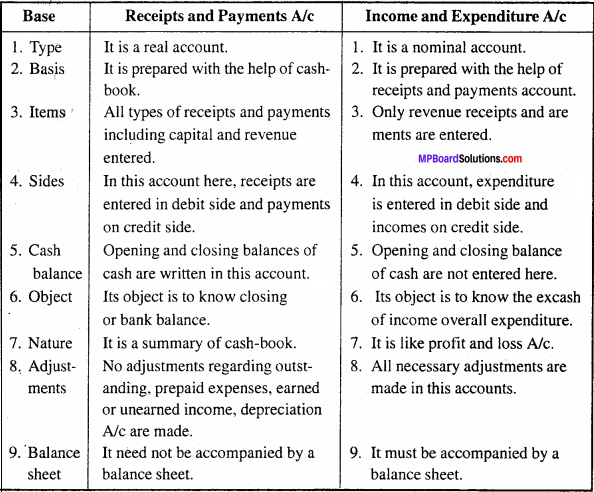

Differentiate between Receipts and payment A/c and income and expenditure A/c.

Answer:

Difference between receipts and payments and income and expenditure A/c:

Question 2.

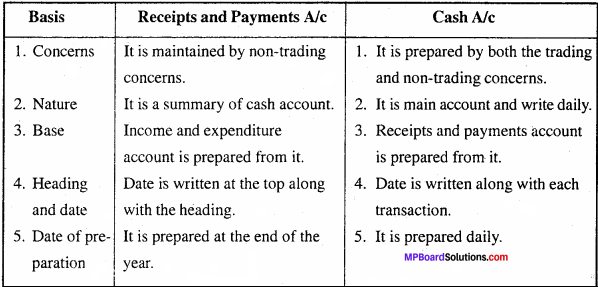

Differentiate the receipts and payments account and cash account.

Answer:

The difference between receipts and payments account and cash account are as follows:

Question 3.

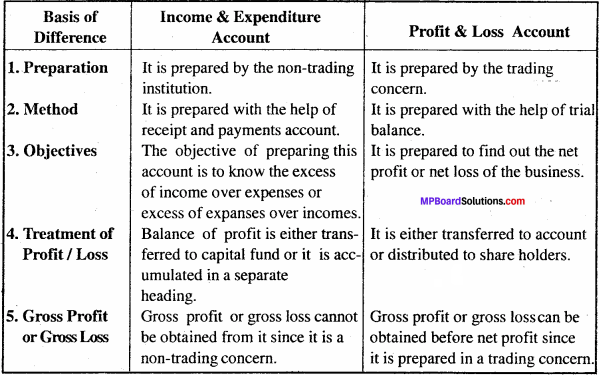

Differentiate between income and expenditure A/c and profit and loss account

Answer:

Difference between income and expenditure account and profit and loss account:

Question 4.

What are the rules of preparing income and expenditure account from receipt and payment account?

Or

What precautions should be taken while preparing income and expenditure account? (Five points)

Answer:

While preparing income and expenditure account the following points should be kept in mind:

- Opening and closing balance of cash are not to enter into income and expenditure account.

- Not to enter capital receipts and capital payments in income and expenditure account.

- Revenue receipts and payments relating to the relevant period is only entered into income and expenditure account whether they are paid or not and received or not.

- While preparing income and expenditure account adjustments regarding outstanding, prepaid, unearned, accrued, etc. should be adjusted.

- Depreciation on assets and provisions for bad and doubtful debts should be maintained.