MP Board Class 11th Accountancy Important Questions Chapter 14 Financial Statement

Financial Statement Important Questions

Financial Statement Objective Type Questions

Question 1.

Choose the correct answer:

Question 1.

Trading Account discloses –

(a) Gross profit

(b) Net profit

(c) Net loss

(d) Gross profit or Gross loss

Answer:

(d) Gross profit or Gross loss

Question 2.

Direct Expenses are entered in:

(a) Trading Account

(b) profit & Loss Account

(c) Balance sheet

(d) None of these

Answer:

(a) Trading Account

![]()

Question 3.

Profit and loss Account discloses:

(a) Gross profit

(b) Gross profit or Gross loss

(c) Gross profit or Gross loss

(d) None of these

Answer:

(b) Gross profit or Gross loss

Question 4.

Goodwill is a –

(a) Fixed Asset

(b) Current Asset

(c) Fictitious Asset

(d) None of these

Answer:

(a) Fixed Asset

Question 5.

Drawing is deducted from:

(a) Sales

(b) Purchase

(c) Returns outward

(d) Capital

Answer:

(b) Purchase

![]()

Question 2.

Fill in the blanks:

- Indirect Expenses are entered in …………….. account.

- Gross profit or loss is transferred to …………….. account.

- ……………. accounts are prepared at the end of the year.

- Balance sheet is a ………………

- Increase in capital at the end of the year represents ………………..

Answer:

- Profit & loss account

- Profit & loss account

- Final

- Statement

- Profit.

Question 3.

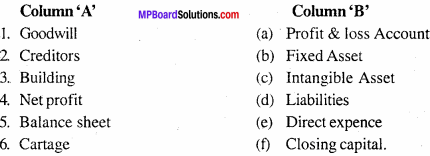

Match the following:

Answer:

- (c)

- (d)

- (b)

- (a)

- (f)

- (e)

Question 4.

Answer in one word/sentence:

- When cost of goods sold is deducted from net sales, we get.

- The Expenses written in profit & loss Account are known as.

- The statement of Assets & Liabilities is called.

- Give an example of current Liability.

- In which side of balance sheet, the goods in transit are shown.

Answer:

- Gross profit

- Indirect expenses

- Balance sheet

- Bank overdraft

- Asset side.

![]()

Question 5.

State True or False:

- Capital is a fixed Liability.

- Closing stock is not shown in balance sheet.

- Balance sheet is prepared on the basis of Trial balance.

- Bad debt reserve is a loss.

- Interest on drawings is loss of owner.

Answer:

- True

- False

- True

- False

- True.

Financial Statement Short Answer Type Questions

Question 1.

What do you mean by trading account?

Answer:

At the end of the financial year, the trader prepares an account called trading account to ascertain the gross profit or loss, of the business, i.e., The result of purchase and sale of goods. In its debit side, opening stock of goods, purchases less returns, wages, freight, carriage, power and fuel, etc. are entered. In its credit side sales less returns, closing stock etc. are entered. Then both, the sides are totalled and balanced. It may be either gross profit or gross loss. The debit balance shows gross loss and credit balance shows gross profit. It will be transferred to profit and loss account.

Question 2.

Explain the meaning of profit and loss account.

Answer:

Profit and Loss Account is an account prepared to find out Net Profit on Net Loss of the business for a particular period. In this account, all indirect incomes and expenses are entered. It starts with either gross profit or gross loss.

Question 3.

What is balance sheet? What are the objects of its preparation?

Answer:

“Balance sheet is a statement which gives information of business liabilities and assets on a particular date of which shows the financial position of the business”.

Objects:

- To ascertain the financial position of the business.

- To show the various assets and liabilities of the business.

- To find out the amount payable to creditors and the amount receivable from debtors.

- To ascertain the capital balance.

- To compare with previous years.

![]()

Question 4.

Write a short note on valuation of closing stock.

Answer:

The unsold goods lies with the seller at the end of the financial year is called closing stock. It is essential to calculate the value of unsold stock at the end of each financial year, before the preparation of final accounts. Without its valuation, the net profit or net loss of the business is not possible to find out. In the following way it is valued.

The valuation of unsold stock is done in two ways, i.e., either in market price or in cost price. Generally, it is done in market price or in cost price which is lower. By doing so, chances of arising loss is minimized.

Question 5.

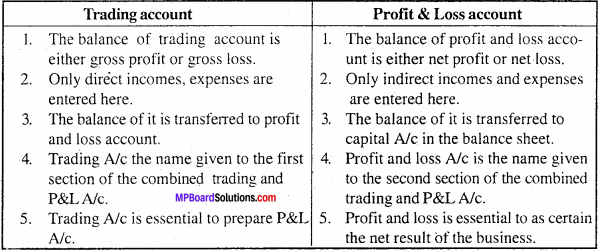

Differentiate between trading account and profit & loss account.

Answer:

Differences between trading account and profit & loss account:

Question 6.

Explain the objects of preparing profit and loss account

Answer:

The following are the advantages of preparing P&L accounts:

- To find out net profit or net loss of the business – The trading, profit and loss account shows the net profit or net loss of the business.

- Comparison – The net profit or net loss ascertained from the P&L account helps to compare it with previous years and plans can be taken to change the business policies.

- To calculate income tax – For the valuation of income tax, it helps the taxation authorities. It is done on the basis of net profit.

- Knowledge of daily expenses – P&L account gives the information of daily expenses and incomes of the business.

- Future plans – On the basis of net profit or net loss, ascertained from P&L account helps’the trader to make plans for the future.

Question 7.

Give the classification of liabilities.

Answer:

Liabilities can be classified as follows:

- Fixed liabilities – The liabilities which are to be paid after a long period of time.

- Current liabilities – The liabilities which are to be paid during short period (1 year) of time.

- Contingent liabilities – Those liabilities whose payment depend on future happenings.

Question 8.

What is meant by financial statement? What are accounts are open in it.

Answer:

At the end of current year for knowing the financial condition of business what¬ever statements are prepared are called financial statement. Trading account, profit & loss account, balance sheet.

![]()

Question 9.

What is meant by closing stock ?

Answer:

The amount of goods remains unsold at the end of the accounting year is called as closing stock. It is necessary to enter closing stock in Dr. side of trading A/c because, profit or loss cannot be ascertained without taking closing stock into consideration.

Financial Statement Long Answer Type Questions

Question 1.

Explain the importance of final accounts.

Answer:

Ahead are the main importance of preparing final accounts:

1. To know the production cost and profit or loss on goods – Trading Account helps to know the cost of production and profit or loss made on goods for a particular period.

2. To know Net Profit or Net Loss of the business – The profit and loss account includes all indirect incomes and expenses, profits and losses of the business for a particular period. It enables us to find out the net profit or net loss of the business.

3. To know the financial position of the business – A Balance Sheet is prepared to find out the financial position of the business on a particular date. This statement contains all the assets and liabilities in its actual value. It must be equal.

4. To increase the earning capacity of the business – Final accounts are prepared in each year. It helps the trader to compare them from year to year. It enables him to find out the reasons of increase or decrease in profit or earning capacity.

5. To help in making future plans – The informations obtained from final account can work as a guideline for the business and on its base, he can make future plans.

![]()

Question 2.

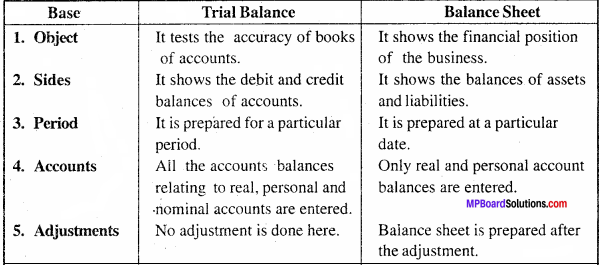

Differentiate between trial balance and balance sheet.

Answer:

Differences between trial balance and balance sheet:

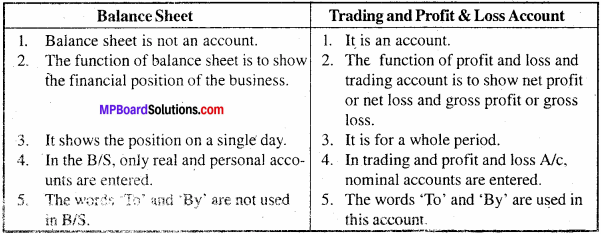

Question 3.

Differentiate between trading and profit & loss account and balance sheet Answer: Differences between balance sheet and profit & loss account:

Question 4.

Explain in brief me items which are written in the debit side of trading account

Answer:

The various iterns that appear in Dr. side of trading account:

- Opening stock – Last year’s unsold stock is brought toward and written as opening stock in trading account

- Purchases – The total amount of goods purchased is reduced by purchase returns.

goods destroyed by fire etc. and net purchases are written. - Direct expenses – It refers to those expenses which are incurred for purchase or production of goods, e.g., carriage purchases, octroi, wages, fuel etc.

- Gross profit – The credit balance of trading account is turned as gross profit. It is transferred to profit and loss account.