MP Board Class 11th Accountancy Important Questions Chapter 13 Bills of Exchange and Promissory Note

Bills of Exchange and Promissory Note Important Questions

Bills of Exchange and Promissory Note Short Answer Type Questions

Question 1.

What are the parties to a bill? Explain.

Answer:

There are three parties to a bill. They are:

- Drawer – He is the person who draws a bill. He is the seller or the creditor. He writes the bill.

- Drawee – He is the person to whom the bill is drawn. He is also known the acceptor of the bill. He is buyer or the debtor.

- Payee – He is the person to whom the payment is made on the due date. He may be the drawer, banker or the endorsee.

Question 2.

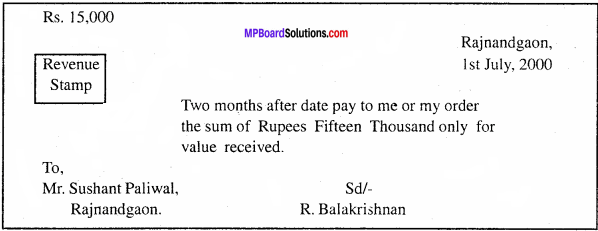

Give a specimen form of ‘Bills of Exchange’.

Answer:

A specimen form of bill of exchange:

Question 3.

What is meant by Accommodation Bill?

Answer:

These bills are written between the two parties for mutual financial help. No debtor-creditor relationship exists in such condition.

![]()

Question 4.

Mention various characteristics of bill of exchange.

Answer:

The characteristics features of bill of exchange are:

- It is an unconditional order

- It must be in writing

- The maker or the writer of the bill must sign on it

- It is drawn on a particular person

- It must be accepted by one person to whom it is drawn

- It is payable on demand or on the expiry of a certain period

- It is written for a certain amount.

Question 5.

Explain renewal of a bill.

Answer:

Renewal of a bill refers to the cancellation of old bill and preparation of new bill for an extended period of time. It is done by the drawer on the request of drawee when the expressor his inability to pay.

Question 6.

What do you mean by renewal of a bill? Explain with an example.

Answer:

Renewal of a Bill:

Sometimes the acceptor of the bill found himself unable to meet his acceptance of the bill on the due date. So, he may request the drawer of the bill for the extension of time. If he agrees, the old bill is cancelled and a fresh one is drawn in place of the old one. For this extension of period, interest is charged and the bill is made with the principal amount and interest.

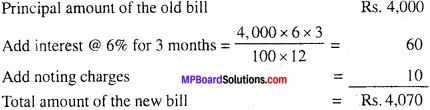

Example : Ram cancelled the old bill of Rs. 4,000 and draw a new bill on Mohan by charging interest at the rate of 6%, for a period of three months. The new bill should include noting charges of Rs. 10 also.

Solution :

Calculation of amount of the new bill

Question 7.

What is meant by dishonour of a bill? Explain in detail.

Or

Explain the procedure of dishonour of a bill.

Answer:

Non – payment of bill on due date due to any reason is known as dishonouring of a bill. In such a case, the holder of the bill can recover the amount from any of the previous endorser or drawer.

Due to the following causes a bill may be dishonoured:

- When the acceptor does not have adequate money to meet his acceptance

- When the acceptor is declared as insolvent

- When the payment is stopped by the Govt

- When the acceptor becomes lunatic, mad or expires.

When a bill is dishonoured, it is essential to certify it by a notary public by the holder in due course. He requests the drawee to make the payment. If again he denies to make payment then he approaches the court to recover the amount from him.

![]()

Question 8.

What entries will be passed in the books of drawer in case of dishonour of a bill in following cases:

- Bill is retained with drawer and he pays noting charges.

- Bill is endorsed to Mr. X and Mr. X pays noting charges.

Answer:

1. If the bill retained with drawer and he pays noting charges:

Drawee’s A/c Dr. – –

To Bills Receivable A/c –

To Cash A/c –

(Being bill dishonoured and noting

charges paid)

2. If bill is endorsed to Mr. X and noting charges are paid by him:

Drawee’s A/c Dr. – –

To Mr. X’s A/c –

(Being bill dishonoured and noting charges paid)

Question 9.

What is a promissory note? Mention some features of promissory note.

Answer:

A promissory note is an instrument in writing containing an unconditional undertaking, signed by the maker to pay a certain sum of money to a person or to his order or to the bearer of the instrument. According to Indian Negotiable Instrument Act, “Promissory note is a promise to make the payment of certain specified amount to the creditor on demand or after expiry of certain period”.

In promissory note, acceptance is not required because the writer himself is the debtor. In’ transactions which are related to promissory note, there are mainly two parties one is maker (debtor) and second is payee (creditor). In this writer promises to pay the amount after certain period.

Special feature of promissory note:

- It is a document in writing.

- It must be a promise by the maker to make the payment in future.

- The promise to pay must be unconditional.

- It is a promise to pay specified amount.

- Payment may be made on demand or after the expiry of certain period.

- It must be signed by the maker of the instrument.

- It should be properly stamped.

Bills of Exchange and Promissory Note Long Answer Type Questions

Question 1.

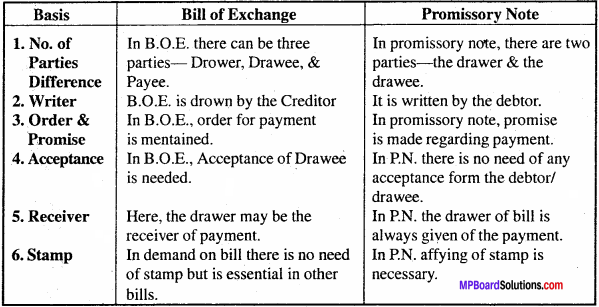

Differentiate between bill of exchange and promissory note.

Answer:

Difference between Bill of Exchange and Promissory Note:

Question 2.

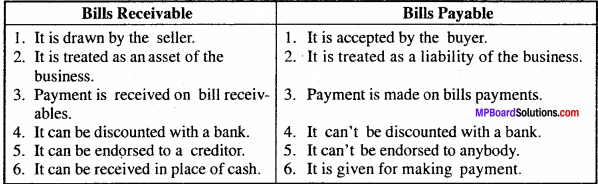

Differentiate between bills receivable and bill payables.

Answer:

The following are the difference between receivables and bill payable:

Question 3.

Explain in the following:

- Days of Grace

- Endorsement of a bill

- Retirement of a bill.

Answer:

1. Days of Grace:

Bill of exchange is written for a definite period. For the convenience of the acceptor, three extra days are allowed to him for making the payment. These extra day’s are known as ‘Days of Grace’. Three days are added to the due date of the bill.

2. Endorsement of a bill:

When the accepted bill is transferred by the drawer in favour of his creditors to pay off his debt is called endorsement. The person who endorses the bill is called endorser and to whom it is endorsed is called endorsee. When a bill is endorsed, the endorsee will be entitled to get the payment.

3. Retirement of a bill:

Sometimes the acceptor makes the payment of the bill before the due date. In this situation, he does not pay full amount of the bill. The drawer agrees to deduct some amount. This amount is called rebate. This is called ‘Retirement of bill under Rebate’.

![]()

Question 4.

Describe types of bills of exchange?

Answer:

Kinds of bills of exchange are as follows:

- On the basis of place.

- On the basis of use.

- On the basis of time.

- On the basis of receiver.

- On the basis of Book – keeping.

1. On the basis of place:

- Inland bill – When drawer and drawee are both from same country then it is called Inland bill.

- Foreign bill – When drawer and drawee both are different countries then it is called foreign bill.

2. On the basis of use:

- Trade bill – A trade bill is used for purchase and sale of goods or commodity.

- Accommodation bill – This bill is drawer by drawer on drawee for meet financial need not for any business transaction.

3. On the basis of time:

- Sight bill – This type of bill are liable for payment at time of presentation. ,

- Tenure bill – This type of bill is to be made by acceptor on the date mentioned in the bill.

4. On the basis of receiver:

- Bearer bill – The payment of such bills is made to that person who present the bills for payment.

- Order bill – The payment of this bill is made to the person whose name is written on the bill on his order to any other person.

5. On the basis of Book – keeping

- Bills receivable – These bills are those, the payment of which is to be received by traders at certain ate.

- Bills payable – These bills are those the payment is made of purchases at certain date.