MP Board Class 12th Accountancy Important Questions Chapter 3 Reconstitution of Partnership Firm: Admission of a Partner

Reconstitution of Partnership Firm: Admission of a Partner Important Questions

Reconstitution of Partnership Firm: Admission of a Partner Objective Type Questions

Question 1.

Choose the correct answer:

Question 1.

The type of asset, goodwill is:

(a) Tangible

(b) Intangible fixed

(c) Current

(d) None of these.

Answer:

(b) Intangible fixed

Question 2.

Revaluation account is opened when:

(a) On admission of new partner

(b) On dissolution of a firm

(c) On amalgamation of a firm

(d) On sale of a partnership firm.

Answer:

(a) On admission of new partner

Question 3.

The equation of sacrificing ratio is: (MP 2014)

(a) Old ratio – New ratio

(b) New ratio – Old ratio

(c) Old ratio + New ratio

(d) None of these.

Answer:

(a) Old ratio – New ratio

Question 4.

Goodwill account is written off in:

(a) Partner’s old ratio

(b) New ratio

(c) New share of new partner

(d) None of these.

Answer:

(b) New ratio

Question 5.

Increase in value of assets is written in which side of revaluation account:

(a) Debit side

(b) Credit side

(c) Debit and credit side

(d) None of these.

Answer:

(b) Credit side

![]()

Question 6.

In which ratio the profit on revaluation is distributed: (MP 2009 Set B, 13,15)

(a) New profit and loss ratio

(b) Old profit and loss ratio

(c) Sacrificing ratio

(d) Gaining ratio.

Answer:

(b) Old profit and loss ratio

Question 7.

The sacrificing ratio of the partner and gaining ratio of the partner is :

(a) More

(b) Equal

(c) Less

(d) Sacrificing ratio is less and gaining ratio is more.

Answer:

(b) Equal

Question 8.

Goodwill is entered into A/c :

(a) When no amount is being given for that

(b) When payment has been given or any asset is been given for that

(c) When it is mentioned

(d) When calculation of goodwill is not mentioned.

Answer:

(c) When it is mentioned

Question 9.

‘A’ and ‘B’ are partners who share profit & loss in the ratio 3:1. They admit C’ for\(\frac { 1 }{ 4 }\)<sup>th</sup> share in profit. New profit sharing ratio will be:

(a) (A) \(\frac { 9 }{ 16 }\) (B) \(\frac { 3 }{ 16 }\) (C) \(\frac { 4 }{ 16 }\)

(b) (A) \(\frac { 8 }{ 16 }\) (B) \(\frac { 4 }{ 16 }\) (C) \(\frac { 4 }{ 16 }\)

(c) (A) \(\frac { 10 }{ 16 }\)(B) \(\frac { 2 }{ 16 }\) (C) \(\frac { 4 }{ 16 }\)

(d) (A) \(\frac { 8 }{ 16 }\) (B) \(\frac { 9 }{ 16 }\) (C) \(\frac { 10 }{ 16 }\)

Answer:

(a) (A) \(\frac { 9 }{ 16 }\) (B)\(\frac { 3 }{ 16 }\) (C)\(\frac { 4 }{ 16 }\)

Question 10.

‘A’ and ‘B’ are partners sharing profit in the ratio 3 : 1. They admit ‘C’ into partnership for \(\frac { 1 }{ 4 }\)th Sacrificing ratio of ‘A’ and ‘B’ is:

(a) Equal

(b) 3 : 1

(c) 2 : 1

(d) 3 : 2.

Answer:

(b) 3 : 1

![]()

Question 11.

On admission of a partner, the General Reserve shown in the balance sheet of the old firm will be transferred to :

(a) All partner’s Capital A/c

(b) New partner’s Capital A/c

(c) Old partner’s Capital A/c

(d) None of these.

Answer:

(c) Old partner’s Capital A/c

Question 12.

‘A’, ‘B’ and ‘C’ are partner’s in a firm. ‘D’ is admitted as a new partner in the firm:

(a) Dissolution of old firm

(b) Dissolution of firm and partnership

(c) Reconstitution of partnership

(d) None of these.

Answer:

(c) Reconstitution of partnership

Question 13.

On the admission of a new partner, the undistributed profits shown in the balance sheet of old firm will be transferred to capital accounts:

(a) In old capital ratio among old partners

(b) In old profit sharing ratio among old partners

(c) In new profit sharing ratio among all partners

(d) None of these.

Answer:

(b) In old profit sharing ratio among old partners

![]()

Question 2.

Fill in the blanks:

- Increase in value of assets due to revaluation is recorded in ……………. side of revaluation account.

- Profit on revaluation is transferred in credit side of ………….. account.Undistributed profit given in liabilities side

- of balance sheet is …………… in partners capital account.

- When changed figures of assets and liabilities are not to be shown in books than …………… account is opened. (MP 2013)

- Amount of the goodwill bought by the new partner is credited to old partners capital account in …………… ratio.

- On goodwill …………. is not calculated.

- Reduction in reserve for bad and doubtful debts will be to revaluationaccount.

- Decrease in liability is …………… for a firm. (MP 2012,15,17)

- ………….. is not charged on goodwill. (MP 2012,15)

- The right over the amount of goodwill rests with ………….. partners. (MP 2013)

- Revaluation account is a …………. account. (MP 2014,16)

- Super profit is that profit which is earned ……………. than normal profit. (MP 2016)

- ……………. of a partnership is a change in relationship among the partnership. (MP 2017)

Answer:

- Credit

- Capital account

- Credited

- Memorandum revaluation account

- Sacrificing

- Depreciation

- Credited

- Profit

- Depreciation

- Old partners

- Nominal

- Excess

- Reconstitution

![]()

Question 3.

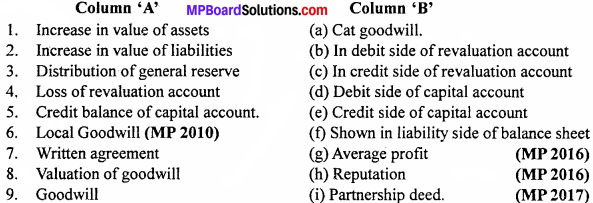

Match the columns:

Answer:

- (c) In credit side of revaluation account

- (b) In debit side of revaluation account

- (e) Credit side of capital account

- (d) Debit side of capital account

- (f) Shown in liability side of balance sheet

- (a) Cat goodwill.

- (i) Partnership deed.

- (g) Average profit

- (h) Reputation

Question 4.

Write true or false:

- Goodwill is an intangible assets, which should be written off soon.

- New partner is not entitled to share firm’s future profits.

- No new partner can be hold responsible for the losses incurred in the firm before his admission.

- If goodwill account is opened, it is shown in balance sheet.

- The entry of unrecorded assets is done in debit side of revaluation account.

- Goodwill is a salable asset. (MP 2009 Set B, 15)

- Super profit = Normal profit – Actual profit. (MP 2009 Set A)

- At the time of new partner’s admission, if the value of any asset decreases, it will be debited to revaluation account. (MP 2010)

- Monopoly decreases the goodwill. (MP 2010)

- On paying the goodwill premium by new partners, it is transferred to old partners capital A/c in their Sacrificing ratio. (MP 2014)

- A, B, C are partners in 3 : 2 : 1 respectively B retires. The new ratio of A and C will be 3 :2.

Answer:

- True

- False

- True

- True

- False

- True

- False

- True

- False

- True

- False.

![]()

Question 5.

Write the answer in one word/sentence:

- The ratio in which existing partners decide to give up their shares in favor of a new partner is called.

- What type of asset is goodwill ? (MP 2017)

- Which type of goodwill fetches the highest value.

- Increase and decrease in assets and liabilities of a firm are transferred to an account called as. (MP 2010)

- Which type of goodwill fetches the lowest value ?

- In case of change in profit – sharing ratio of existing partners where is profit on revaluation of assets and liabilities transferred ?

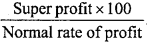

- Good will =

In which method this formula is used for good will valuation ? (MP 2015) - A.S.-10 is related to. (MP 2015)

- When liabilities of the partner are more than his assets, then it is called as (MP 2013)

- Purchase Consideration – Net Assets = ? (MP 2013)

- What is normal profit ? (MP 2014)

- What is the base of valuation of goodwill. (MP 2016)

Answer:

- Sacrificing ratio

- Intangible

- Cat goodwill

- Revaluation account

- Rat goodwill

- Capital account of partners

- Capitalization of goodwill

- Goodwill and fixed asset

- Insolvent

- Goodwill

- Super profit – actual profit

- Profit.

![]()

Reconstitution of Partnership Firm: Admission of a Partner Very Short Answer Type Questions

Question 1.

Write three reasons to give admission to a new partner.

Answer:

Due to the following reasons a partner may be admitted:

1. To raise capital: When the firm needs more capital, a new partner is admitted to fullfill their need.

2. Need of a skill full partner: If the firm needs an able, skillful and intellectual person for the development and efficient running of the business, the firm can admit a new partner to full fill their need.

3. On death of a partner: On death or retirement of a partner there gets a blank in the firm and in order to fill the space a new partner is admitted in the firm. This helps the firm to receive additional capital from the incoming partner and his experience.

Question 2.

What are the rights of new partner in a firm ?

Answer:

Rights of new partner:

- Right to share in the future profits of the firm.

- Right to share in the assets of the firm.

Question 3.

Define goodwill.

Answer:

According to Lord Macnaughton, “Goodwill is a thing which is easy to describe, but difficult to define. It is the benefit and advantage of good name, reputation in connection of a business. It is the one thing which distinguishes an old established business from a new business as it first starts. Goodwill is composed of variety of elements. It differs in its composition in different trades and in different business in the same trade.”

Question 4.

What do you mean by local goodwill ?

Answer:

When the goodwill always remains with the place of the place is called cat goodwill. The nature of the cat is that, it always lives at its place. The owners of the business may change, but goodwill doesn’t change its place like cat. Therefore, its nature is compared to the nature of the cat.

Question 5.

Write the methods of valuation of goodwill.

Answer:

Following are the important methods :

- Average Profit Method

- Super profit Method

- Capitalization Method

- Annuity Method.

![]()

Question 6.

Write entry for writing off the goodwill account when a partner is admitted.

Answer:

The following entry is passed when the goodwill account is written-off in the event of admission of a partner.

All the Partners Capital A/c – Dr.

To Goodwill Account

(Being goodwill account written off).

Question 7.

What is personal goodwill ?

Answer:

It raises due to the individual qualities and efficiency of particular personnel. Values of such goodwill is usually less. It is also called ‘Dog nature of goodwill’.

Question 8.

What is sacrificing ratio ?

Answer:

Due to admission of a new partner in the firm the old partners share in the firm’s profits is bound to reduce. Hence, sacrificing ratio means the ratio in which the old partners abandon the fraction of their in the profits of business, in favor of new partners.

![]()

Question 9.

what is Memorandum revaluation account ?

Answer:

When all the partners (including the new partner) decide that despite revaluation, the value of assets and liabilities are to be shown at their original value, as such a memorandum revaluation account is prepared.

Question 10.

Write names of different methods of calculation of goodwill.

Answer:

Following methods are used to calculate goodwill:

- Average profit method

- Super profit method

- Capitalization method

- Annuity method.

![]()

Reconstitution of Partnership Firm: Admission of a Partner Short Answer Type Questions

Question 1.

What are the characteristics of goodwill ?

Answer:

‘Goodwill’ is defined as follows:

- According to J. O. Mage: “The capacity of a business to earn profits in the future is basically what is meant by the term Goodwill”.

- According to Lord Elden: “Goodwill simply means that old customers will resort to the old place”.

The following are the characteristics of goodwill:

- Goodwill is treated as an asset of the business

- Goodwill is an intangible asset. It can’t be seen or be touched. It can only be imagined

- Goodwill helps to make more profits

- Goodwill can be calculated

- The value of goodwill always fluctuates.

Question 2.

‘Goodwill is an intangible asset”. Explain.

Or

“Goodwill is an intangible assets which should be written-off soon from the books. Explain.

Answer:

Every businessman tries to earn its name or reputation and popularity in business field. It is called ‘Goodwill’. Like other assets it is also as an asset. But it can’t be seen or be touched. It has no physical shape. That is why it is known as intangible asset.

This goodwill helps to earn more profit to the businessman. Some experts are having the opinion that goodwill is an intangible asset. According to them, it is having no fixed value. Always it varies, so it should not be shown in balance sheet. It should show up to the distribution of it and after that it should be written off.

Question 3.

‘Write those conditions when valuation of goodwill is essential in partner-ship’v(Any five)

Answer:

In the following cases valuation of goodwill is essential in a partnership :

- When a new partner is admitted in a firm

- When a partner is retiring or on the event of death of a partner

- When two partnership firms are amalgamating

- When the partnership is changing into a company

- When the partners desire to change their profit and loss sharing ratio.

Question 4.

(i) What do you mean by revaluation account ?

(ii) Why it is prepared ? How it is prepared ?

Answer:

(i) When a new partner is admitted in a partnership firm it is necessary to re-value the various assets and liabilities. For entering this effect an account is opened. This account is known as revaluation account or profit and loss appropriation account.

(ii) The revaluation account is opened for the following purposes :

- Increase or decrease in the value of assets and liabilities and its social effect.

- When a new partner is admitted, the revaluation account balance should be adjusted to the old partner’s capital account and on retirement it should be transferred to capital accounts of all the partners.

Preparation of revaluation account:

When the cost of assets and liabilities are revalued it is entered in revaluation account. In this account, losses are debited and gaining of profits are credited. The balance of this account will later be transferred to the old partner’s capital account in their ratio.

![]()

Question 5.

In what conditions, revaluation account is prepared ?

Answer:

On following conditions, revaluation account is opened in the firm:

- When a new partner is admitted in the firm.

- When an old partner retires from the firm.

- When an old partner had died

Question 6.

Explain the method of valuation of goodwill on average profit basis with example.

Answer:

Valuation of goodwill on ‘Average Profit Method’:

Under this method, good-will is valued on the basis of average profit of the last few years. It is found out by totaling the profit of last few years and then divide it with number of years, later the resulting amount should be multiplied with the number of purchase price. The resulting figure should be the amount of goodwill.

Example:

He mant Traders made the following profits and losses during the last 5 years :

1988: Rs. 15,000

1989 : Rs. 13,000

1990 : loss Rs. 8,000

1991 : Rs. 10,000

1992 : Rs. 15,000.

Calculate the amount of goodwill at 2 years purchase price of the average profit of last 5 years.

Solution:

Goodwill is calculated as under:

![]()

= \(\frac { (15,000 + 13,000 + 10,000 + 15,000) – 8,000 }{ 5 }\)

= \(\frac { 53,000 – 8,000 }{5 }\) \(\frac { 45,000}{ 5 }\) = Rs. 9,000

Goodwill = 9,000 x 2 = Rs.18,000

Reconstitution of Partnership Firm: Admission of a Partner Long Answer Type Questions

Question 1.

Explain the causes of creation of ‘Goodwill’.

Answer:

The following are the causes of creation of ‘Goodwill’.

1. Situation of a market: Business should be started in such a place where the buyers can easily come and buy the goods. It will increase the sales and profits of the business.

2. Good business dealings: If the businessmen are keeping good relation with the customers, it will automatically increase the reputation and sales.

3. Good quality of goods at reasonable price: If the businessmen sell their goods of good quality at reasonable price, more customers will be attracted and the sales will normally be increased.

4. Give maximum convenience to the customers: The customers like to go to that shops where there are credit facilities and also there should be arrangement for home delivery of goods.

5. Influence of advertisement: Due to continuous advertisement there should be chances of increasing the sales. e.g., Nirma Powder.

![]()

Question 2.

Explain the methods of valuation of goodwill.

Or

What are the different methods of valuation of goodwill ? Explain calculation of goodwill as per average profit method.

Answer:

Valuation of goodwill is a difficult task. Generally, its valuation is done in the following ways :

1. Average profit method:

Under this method, the average profit of last years is found out at first. Then this average is multiplied with the number of years (purchase price). The resulting figure should be the amount of goodwill.

2. Super profit method:

Under this method, super profit is found out at first. Then

this figure is multiplied with the number of years (purchase price). The resulting amount should be the goodwill.

3. Capitalization method:

Under this method, it is assumed that the capital in-vested in the business brings profit. If the invested capital brings super profit or extra profit, it is treated as the goodwill of the firm.

4. Annuity method:

Under this method, it calculates that how many years the firm will earn super profit. Then this super profit (extra profit) is multiplied with annual interest (rate).

i.e., Goodwill = Super profit x Annual rate.

![]()

Question 3.

What is hidden goodwill ? How it is calculated ?

Answer:

hidden goodwill:

If is the value of goodwill that is not mentioned at the time of admission of a new partner. If in the question, it is mentioned that the new partner requires to bring his/her share of goodwill, then in between the capitalized value of the firm’s goodwill need to be calculated. It is calculated by taking the difference between the capitalized value of the firm and the net worth of the firm.

1. Calculation of total capital of the new firm:

First of all, on the basis of the new partners’ share of capital, the total capital of the firm is calculated. For example, if the new partner brings Rs. 10,000 as capital for 1/4 share, then the total capital will be Rs. 10,000 x 4 = Rs. 40,000.

2. Calculation of Actual capital (Sum of old and new partners):

Total capital of the old partners + capital brought by new partner is the actual capital of the, firm. Suppose the old partners’ capital is Rs. 25,000 and the new partner bring^s. 10,000 as capital. Then the actual capital of the firm will be Rs. 35,000 (Rs. 25,000 + Rs. 10, 000).

3. Determination of hidden Goodwill:

Excess of the total capital of the new firm over the actual capital i.e., sum of old and new partners’ capital is assumed to be hidden goodwill. Suppose the total capital of the new firm is Rs. 40,000 and the sum of old partners and new partners’ capital is Rs. 35, 000, then the difference Rs. 5,000 (Rs. 40,000 – Rs. 35, 000) will be the hidden goodwill.