MP Board Class 11th Accountancy Important Questions Chapter 2 Fundamental Assumptions and Principles of Accounting

Fundamental Assumptions and Principles of Accounting Important Questions

Fundamental Assumptions and Principles of Accounting Objective Type Questions

Question 1.

Choose the correct answer:

Question 1.

Generally the duration of an Accounting period is of –

(a) 6 months

(b) 3 months

(c) 12 months

(d) 1 month.

Answer:

(c) 12 months

Question 2.

The sum of Liabilities and Capital is –

(a) Expense

(b) Income

(c) Drawings

(d) Assets.

Answer:

(d) Assets.

Question 3.

In India, the accounting standard board was set up in the year –

(a) 1972

(b) 1977

(c) 1956

(d) 1932.

Answer:

(b) 1977

![]()

Question 4.

The basic accounting postulates are denoted by –

(a) Concepts

(b) Book – keeping

(c) Accounting standards

(d) None of these.

Answer:

(a) Concepts

Question 5.

The amount drawn by businessmen for his personal use is –

(a) Capital

(b) Drawing

(c) Expenditure

(d) Loss.

Answer:

(b) Drawing

Question 6.

Meaning of credibility of going concern is :

(a) Closing of business

(b) Opening of business

(c) Continuing of business

(d) None of these.

Answer:

(c) Continuing of business

Question 2.

Fill in the blanks:

- ……………. is a document that verifies the business transaction.

- The existence of business is different from its ………………

- …………….. has been applied on accountants by accounting standard board, law or professional institutions.

- …………….. aspects are affected in every transaction.

Answer:

- Voucher

- Owner

- Code of conduct

- Two.

![]()

Question 3.

Answer in one word/sentence:

- When was Indian Accounting standard board formed?

- “The rules and conventions of accounting are commonly referred to as principles.” Who said it?

- On what basis accounting principles are developed?

- Which concept denotes that the existence of business is separate from its owner?

Answer:

- 21 st April, 1977

- R.N. Anthony

- Accounting Conventions & Concepts

- Business entity concept.

Fundamental Assumptions and Principles of Accounting Short Answer Type Questions

Question 1.

Explain each of the following in about 50 words:

- Accounting period concept

- Going concern concept

- Business entity concept

- Money measurement concept.

Answer:

1. Accounting period concept:

Every businessman wish to know the result (profit or loss) of the business for a given period. For this purpose, he compares the capital which is invested in the business during the commencement of business with the total value of assets. This accounting period is so long that we are unable to calculate, i.e., he wants to know how his invested money is utilized in the business after a particular period of time.

For tax assessment like income tax, sales tax, etc. accounting period is considered. Generally, this period is one year. During the end of the year, the financial result and financial position is ascertained by making a financial statement.

2. Going concern concept:

Going concern concept means, the business will continue in future also, i.e., the business will continue for an indefinite period. The business will not be closed down in immediate future. According to Kohler a going concern is that “Any enterprise which is expected to continue operating indefinitely in the future.

Due to this reason an accountant adjusts various adjustments in the final accounts in this concept. Viz outstanding expenses, prepaid expenses, accrued income, unearned income, depreciation on fixed assets, etc.

3. Business entity concept:

According to this concept, the business is considered to be a separate entity or unit. These all the transactions are recorded from the point of view of the business and not from the point of view of the proprietor. Even the proprietor is treated as a creditor of the business when he invests money as capital. This rule is applied in all types of business whether it is sole trade or partnership or company. Due to this reason, the profit or loss is correctly ascertained, along with its financial position to a particular period.

4. Money measurement concept:

This concept implies that only those transactions are entered in the books of accounts which can be measured in terms of money. The transactions must be of financial nature. Those transactions or events are not recorded in the books which cannot be expressed in monetary terms.

For example:

The production policy, superior quantity of goods, purchase of 200 acres of land, 100 tonnes of coal etc. Thus, In order to record a transaction or an event, it must be expressed in terms of money.

![]()

Question 2.

Write short notes on the following:

- Dual aspect principle

- Principle of full disclosure

- Accounting equation principle

- Historical cost principle.

Or

Explain the Principle of full disclosure.

Answer:

1. Dual aspect principle:

According to this principle, each transaction has two aspects or two sides, i.e., a debit aspect and credit aspect or a debit side and a credit side.

For example:

Shubham started a business by investing Rs. 50,000 in cash. In this transaction, on one side cash and on the other side Shubham who has contributed cash by way of capital is taken. The cash is treated as the asset of the business on one side and Shubham the proprietor (capital) as a business liability on the other side, because the amount invested is not of the business but of a person named Shubham. Here, it formulates the accounting equation:

Assets = Liabilities. This concept is the core of accountancy. All the business transactions are entered on the basis of this concept. Their concept gave birth to ‘Double Entry System’ of book – keeping.

2. Principle of full disclosure:

It means all the material information regarding the accounting should be given. It is the speciality of this principle that, whenever accounting work is done all the relevant rules along with detailed description is to be given regarding the accounts. For the fulfilment of accounting work, this is essential, therefore a format of ‘ final account is given, for its preparation under the Companies Act 1956.

It is essential for a company to show its financial position, i.e., (i) Aprofit and loss account and (ii) A Balance Sheet in a prescribed form. Scholar Committee has also pointed out that for responsible transactions, full disclosure is good for a company. As a result of full disclosure, businessmen, investors and all other interested parties should get detailed and essential informations, as when they are needed.

3. Accounting equation principle:

For the recording of business transaction some accounting equations are popular. The whole entry of business transaction depend on those accounting equations. Hence, they are known as accounting equation convention. Some of them are as follows:

- Assets – Liabilities + Profit.

- The debit total of all the accounts must be equal to the total of all the accounts. i.e., Debit total = Credit total.

- When one person is receiver, the other is giver. All the receipt are equal to all the payments. It is cleared from the following equation.

Expenses + losses + assets = Liabilities + Capital + Profit + Incomes.

Accounting equation:

An example

(i) When a businessman starts a business by investing Rs. 40,000, the accounting equation is:

Capital = Assets Rs. 40,000 = Rs. 40,000.

(ii) Out of cash Rs. 40,000 he purchased a machine for Rs. 10,000, a furniture for Rs. 5,000 and goods for Rs. 4,000, the accounting equation is:

Capital = Machine + Furniture + Goods + Cash

Rs. 40,000 = Rs. 10,000 + Rs. 5,0.00 + Rs. 4,000 + Rs. 21,000.

(iii) When he takes a loan of Rs. 10,000 for the business, the equation is:

Capital + Loan = Machine + Furniture + Goods + Cash

[Rs. 40,000 + Rs. 10,000 = Rs. 10,000 + Rs. 5,000 + Rs. 4,000 + (Rs. 21,000 + Rs. 10,000)].

(iv) When he sold goods costing Rs. 2,000 at Rs. 3,000 cash, the accounting equation is:

Capital + Loan + Profit = Machine + Furniture + Goods + Cash

[Rs. 40,000 + Rs. 10,000 + Rs. 1,000 = Rs. 10,000 + Rs. 5,000 + Rs. 34,000 + (4,000 – 2,000)].

4. Historical cost principle:

According to this principle all the transactions are shown in the books of accounts at their original cost and at its present value. Depreciation is to be charged on the original cost of an asset. However, it must be remembered that the cost concept never means that assets are always shown at its cost price year after year. If an asset is purchased by paying nothing, it would not be shown in the Balance Sheet as an asset. On the other hand, the assets which are received as donation or charity are shown there.

![]()

Question 3.

What are the Modifying principles of Accounting? Explain.

Answer:

Modifying Principles of Accounting:

There are certain principles which can be modified as per the needs of the business. In Order to maintain the reliability of Accounting. Modification or change in existing principles is necessary. Infact the exceptions of Accountancy principles are called as modifying principles. They are as follows:

1. Materiality:

This principle implies that those items should also be entered in the books of accounts, which effect the financial result of the business. Those items which are not important may be left out. The selection of items depends on circumstance. Sometimes some items becomes more important due to its circumstance and some become unimportant and may be left out due to its circumstance. So, special care must be given when such items are dealt with.

2. Consistency:

This principle implies that there should be similarity in accounting procedure in each and every year. But, if need arise, these rules can be changed and on that basis accounts can be maintained.

For example:

For charging depreciation, for creating provision for doubtful debts, for the valuation of unsold stock etc., the rules adopted should be similar, in each year similar type of accounting procedure helps in comparison of accounts every year. As a result we can ascertain whether the business or industry is progressing or not.

3. Conservation:

Principle of conservation implies that the losses which may arise in future are entered in accounts; but not the profits. The importance of this convention is that, by keeping in mind, the losses which may arise in future, the minimum amount of net profit is shown in the account.

For example:

If the value of closing stock is less than the invoice price or the market price, it should be shown only on that price, whichever is lower. For doubtful debts from sundry debtors, a provision or reserve for doubtful debtors is to be created, charge depreciation on fixed assets, etc.

![]()

Question 4.

Write a Short Note on ‘Accounting standard’?

Or

What do you understand by accounting standards?

Answer:

Accounting Standard:

The generally accepted accounting principles has been developed on the basis of various concepts and conventions of Accounting. There are alternate customs existing to record the financial transactions on the basis of these developed principles. Due to the difference in accounting customs arid traditions, there is a lack of similarity and comparability in the financial statements prepared by different business organizations engaged in similar business operations.

Hence there is a need to bring similarity in various existing accounting customs and traditions and to certify them so that each party having interest in the business could be benefitted in order to bring similarity in accounting policies and principles. International accounting standard committee or IASC was established on 29th june, 1973. In India, Accounting standard board or ASB was setup on 21st April, 1977 for the same purpose.

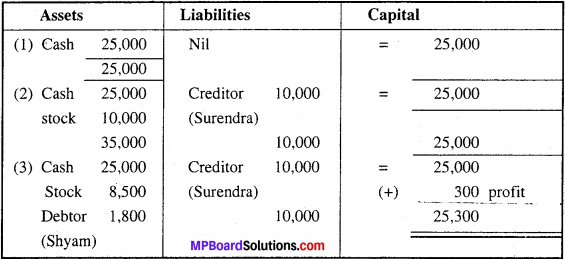

Question 5.

Prepare Rajesh’s accounting equation from the following information?

- Commenced business with cash Rs. 25,000.

- Bought goods from Surendra Rs. 10,000.

- Sold goods to Shyam Rs. 1,800 (cost 1,500).

Answer:

Accounting Equation:

Question 6.

Describe the nature of accounting principles?

Answer:

The nature of accounting principles are as follows:

1. Developing – Accounting principles are influenced by financial statement technique of business and tradition and custom of business so they are developing.

2. Man – made principles – These are man – made principle. These principles cannot be experimented in any lab. These principles are based on logic, experience and implementation.

3. Universally not acceptable – Ail the accounting experts are not agree at any one principle.

4. Lack of brief analysis list – Brief analysis list is not available at are place.

![]()

Question 7.

Mention any 5 limitations of Accounting?

Answer:

Limitations/Disadvantages of Accountancy:

1. Incomplete information:

In accountancy, only those transactions are recorded which are monetary in nature. It records only those transactions which are of quantitative aspect. Government policies, economic and political situation, etc. do not find any place in accounting.

2. Showing valueless asset:

There are some assets which do not have any original value but they are shown in balance sheet. They are goodwill, patents, trade mark, preliminary expenses, etc. The value of these assets are assumed and then shown in balance sheet. This assets when shown in the balance sheet makes the financial result doubtful.

3. In accuracy:

Various accountants determine the valuation of stock, method of charging depreciation according to the way they like. Based on this mode the profit and loss is determined on the basis of real or assumed estimation. The result of the business changes with the change in practise.

4. Ignorance about the present value of the assets:

Business is carried out for an indefinite period. So, the assets are shown in the balance sheet at its book value and not at market value. Moreover, some assets after becoming valueless are shown in the balance sheet even. Hence, accountancy ignores to show the present sale value of the asset.

5. Manipulation:

Accounting records are based on the information supplied. Accountant shows the portion of the business as deserved by the owner. In this condition, the underestimation or overestimation of asset takes place and this is done by omitting certain account.