MP Board Class 11th Accountancy Important Questions Chapter 18 Preparation of Accounts from Incomplete Records

Preparation of Accounts from Incomplete Records Important Questions

Preparation of Accounts from Incomplete Records Objective Type Questions

Question 1.

Choose the correct answer:

Question 1.

A system of accounting which is not based on double entry system is called –

(a) Cash system

(b) Mahajani system of accounting

(c) Incomplete accounting system

(d) None of these.

Answer:

(c) Incomplete accounting system

Question 2.

Accounts which are maintained under single entry system –

(a) Personal accounts

(b) Impersonal accounts

(c) (a) & (b) both

(d) None of these.

Answer:

(a) Personal accounts

Question 3.

Statement of affairs is prepared to –

(a) Know about assets

(b) Know about liabilities

(c) Calculate capital

(d) Know financial position.

Answer:

(c) Calculate capital

![]()

Question 4.

Liabilities and assets amount to Rs. 50,000 and Rs. 78,000 respectively. The difference amount will represent –

(a) Creditors

(b) Debentures

(c) Profit

(d) Capital.

Answer:

(d) Capital.

Question 5.

Generally incomplete records are maintained by –

(a) Trader

(b) Society

(c) Company

(d) Government.

Answer:

(a) Trader

Question 2.

Fill in the blanks :

- Single entry system can be adopted by ………………

- ……………. Accounts are maintained under single entry system.

- Single entry system is not a …………….. system of maintaining accounts.

- While calculating profit. Drawings will be added to …………….

Answer:

- Sole trader or partnership firm

- Personal

- Scientific

- Closing capital

Question 3.

State True or False:

- Profit can be determined by preparing statement of affairs in single entry system.

- Single entry system cannot be converted into double entry system.

- Excess of assets over liabilities is called capital.

- Closing capital is deducted from opening capital to calculate profit in single entry system.

Answer:

- True

- False

- True

- False.

![]()

Question 4.

Answer in one word / sentence:

- Which account is prepared to know the credit purchase?

- What is found out by preparation of opening statement of affairs?

- Which amount will be credited on accepting new bills?

- Which account is debited on dishonouring of a bill?

Answer:

- Creditors account

- Opening capital

- Bills payable

- Debtor’s A/c.

Question 5.

Match the following:

Answer:

1. (b)

2. (a)

Preparation of Accounts from Incomplete Records Short Answer Type Questions

Question 1.

“Single entry system is an unscientific and.incomplete system of accounting”. Justify the statement.

Or

Mention the various limitations of single entry system.

Or

What are the disadvantages of single entry system?

Answer:

Limitations of Incomplete Records:

1. No record of impersonal Accounts”

Under single entry system, weightage is given only to personal Accounts while Impersonal Accounts are ignored i.e., Real and Nominal Accounts are not recorded in Books of Accounts.

2. Preparation of Trial Balance is not possible:

As only one aspect of the transaction is recorded, Arithmetical accuracy cannot be checked by preparing Trial Balance.

3. Possibility of Fraud and Defalcation:

There exists a lack of control over this system which increases the possibility of fraud, Defalcation, deception, Misappropriation etc.

4. No possibility of Comparison:

Single Entry System fails to disclose the Actual Financial position of the business due to non-recording of both aspects of the transactions. This restricts a trader to ampare the financial position of business of current year to that of previous year or years. Thus a trader is not in a position to conclude whether his business is progressing or regressing.

5. No knowledge of Financial position:

Due to Incomplete records, Balance Sheet cannot be prepared and hence financial position of the business cannot be determined.

6. Difficulty in Rectification of Errors:

It becomes difficult for a person to detect the Errors in this system due to lack of complete records. Thus rectification of Errors also becomes troublesome.

7. Valuation of Assets not possible:

As we know that Real and Nominal Accounts are ignored under this system, valuation of Assets is not possible. It greater problem at the time of disposing Assets and Assessment of Goodwill at the time of selling business.

8. Difficulty in Assessment of Tax:

The Income tax Department and sales tax department do not admit or recognize the accounts kept under Single Entry System for assessment of tax. It is so because it creates difficulty in determining the true profit of business and assessing tax thereon.

![]()

Question 2.

State some merits of Single Entry System.

Answer:

Single Entry System has the following merits:

1. Economical:

Less amount is spent on maintaining the requisite books i.e., cash – book and ledger book. Hence it is Economical and suitable for those businessmen whose number of business transactions are few or the size of the business is small.

2. Suitable for certain transactions:

It is suitable for these businessmen who deal in cash transactions and maintain personal accounts of their customers.

3. Suitable for sole trader:

As it is not Mandatory for sole traders to get registered, they are not legally bound to maintain Accounts under Double Entry system. Thus they opt for Single Entry System as it is easy, simple and economical.

4. Simple method:

This method is simple and easy to understand. No special training is required to maintain accounts under this system.

5. Flexibility:

Being more practical, this system helps a businessman to get rid of rigid rules of Double Entry System. It can be changed or altered according to the need.

6. Tax Evasion:

Single entry system is an Incomplete system of Book-keeping which provides sufficient scape to a businessman to incomplete Accounts and save tax. Hence, sometimes it is purposely adopted by businessmen.

Question 3.

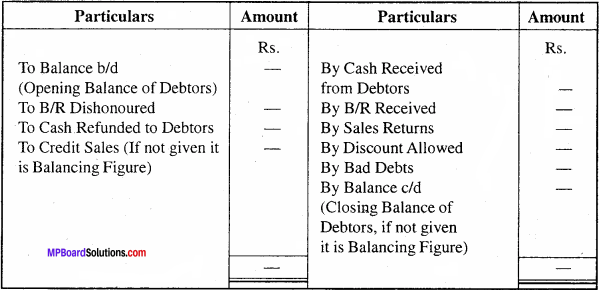

Give a specimen of Total Debtors Account.

Answer:

Total Debtors Account:

Question 4.

What is meant by single entry?

Answer:

In this system all the business transactions are not kept or not recorded in two sides of accounts. In this system transaction are recorded only one side or only are A/c. Hence recording of transaction is incomplete so this system is called incomplete system of accounting. In this, system only cash A/c and some personal account are kept. Nominal and real accounts are ignored so this system is hardly used.

Question 5.

Write some characteristics of single entry system.

Answer:

some characteristics of single entry system are as follows :

- Suitable for sole traders – The system is suitable for only single ownership business or sole tradership only.

- Related to personal accounts only – In this system only accounts related to personal A/c are opened real and nominal A/c are ignored.

- Mixed cash – book – In this system personal transactions are recorded in single cash book. Hence it can be said that in this system Mixed cash – book is maintained.

- Lack of uniformity – In this system all the activities are not like double entry system. In this system some accounts are opened and some are ignored. So we can say in this system Lack of uniformity.

- Profit only a Gues – The profit calculate under this system is based on estimation and not an a actual Financial transaction. So we can say profit is only a gues in this system.

Preparation of Accounts from Incomplete Records Long Answer Type Questions

Question 1.

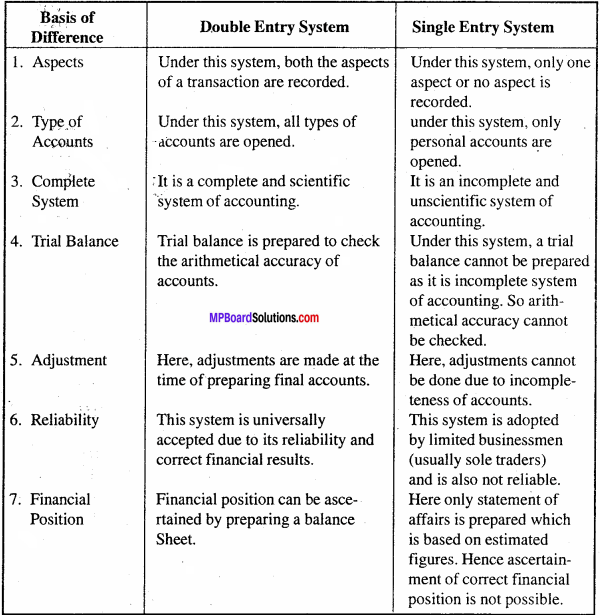

Mention the difference between Double Entry System and Single Entry System.

Answer:

The various differences between Double Entry System and Single Entry System are mentioned ahead:

Answer:

Question 2.

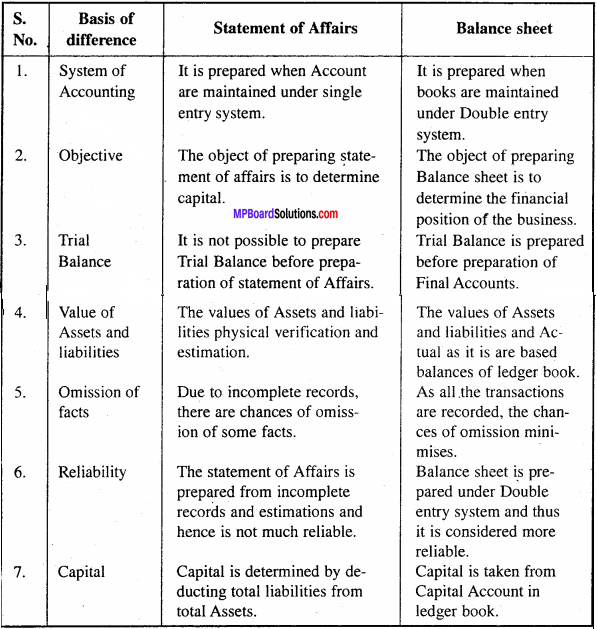

Differentiate between Statement of Affairs and Balance Sheet.

Answer:

Difference between Statement of Affairs and Balance sheet:

Question 3.

Explain the method of converting Single Entry System into Double Entry System.

Answer:

Conversion to Double Entry System Method: True Financial position and Actual profit or loss of the business cannot be determined from the Accounts kept under Single Entry System. Hence, in order to make them complete and more reliable, it is required to convert it into Double Entry System.

The system of conversion of single entry into Double Entry depends on the data available as the former includes lot of Incomplete information. Hence there is no fixed or certain method but generally the following procedure is adopted:

1. Opening statement of Affairs : First of all, opening statement of Affairs is prepared from the initial balances so as to determine the initial capital.

2. Preparation of cash – book : After, preparing opening statement of Affairs, cashbook is prepared. Accounts of all the items appearing in the Dr. and Cr. side of cash – book is opened and posting is done as per the rule.

(a) Items of Dr. side:

- Cash received from Debtors (cash/cheque).

- Cash sales

- Income from investment

- Receipts from sale of Assets etc.

(b) Items of Cr. side:

- Payment to Creditors

- Payment of wages, salaries and other expenses

- Purchase of Assets.

- Drawings by the proprietor etc.

The purpose of preparing cash – book is to ascertain the opening or closing balance of cash and bank of opening balance of cash and bank balance is mentioned in the question then closing balances can be ascertained by preparing cash – book. Similarly, if the closing balances are given, opening balances can be found out by preparing cash – book.

![]()

3. Preparation of subsidiary book:

After preparing cash – book, subsidiary books are prepared and the sum total of these books are transferred to the relevant accounts in the ledger book. Apart from this, posting must also be done in the personal Accounts appearing in the various subsidiary books. Accounts are prepared under it as ahead.

(A) Total Debtors A/c:

By preparing total Debtors A/c, generally the amount of ‘Credit sales’ or ‘Closing Debtors’ is found out. Similarly, if both the mentioned, items are given then ‘Opening Debtors” or ‘Cash received from Debtor’ can be known by preparing Total Debtors A/c sometimes it happens that any one item from the above mentioned four items is missing which can be easily ascertained by preparing Total Debtors A/c.

(B) Total Creditors A/c:

By preparing total Creditors A/c, Amount of credit purchases or closing ‘Creditors’ is ascertained. If these amounts are already given then the amount of ‘Opening creditors’ or ‘Amount paid to Creditors’ can be found out. In case any three items are given, fourth can be determined, Easily from the balancing figure by preparing Total Creditors A/c.