MP Board Class 11th Accountancy Important Questions Chapter 4 Journal

Journal Important Questions

Journal Objective Type Questions

Question 1.

Choose the correct answer:

Question 1.

The first book of original entry is –

(a) Journal

(b) Ledger

(c) Trial Balance

(d)None of these.

Answer:

(b) Ledger

Question 2.

‘Drawings’ falls under which account –

(a) Personal account

(b) Real account

(c) Nominal account

(d) None of these.

Answer:

(a) Personal account

![]()

Question 3.

Income tax is treated as –

(a) Business Expense

(b) Direct Expense

(c) Personal Expense

(d) Indirect Expense.

Answer:

(d) Indirect Expense.

Question 4.

A cheque on which two parallel lines are drawn in the left top corner is called –

(a) Bearer cheque

(b) Traveller’s cheque

(c) Account payee cheque

(d) None of these.

Answer:

(c) Account payee cheque

Question 2.

Fill in the blanks:

- The amount which cannot be recovered from debtors is called ……………..

- The account in which amount can be deposited or withdrawn daily and which allows no interest on deposit is called ……………..

- The discount allowed on cash transactions is called ……………..

- Sales account always shows …………….. balance.

Answer:

- Bad debts

- Current account

- Cash discount

- Credit.

Question 3.

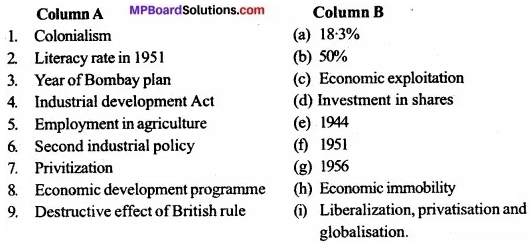

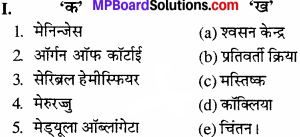

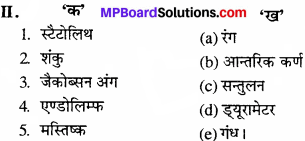

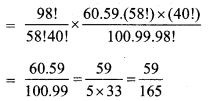

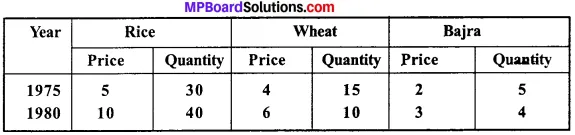

Match the following:

Answer:

1. (b)

2. (a)

3. (d)

4. (c).

Question 4.

State True or False:

- Weekly information is sought from the subsidiary books.

- Drawings account is a personal account.

- Purchase account is always debited.

- Order for sending goods is not a business transaction.

- Cash A/c is a real A/c.

Answer:

- False

- True

- False

- True

- True.

![]()

Question 5.

Answer in one word/sentence:

- Under how many heads, the accounts have been categorised for the purpose of recording transactions in Journal?

- When a single journal entry is passed for two transactions of same nature on same date, such an entry is called?

- Give an example of intangible asset?

- The discount which is offered to increase sale and attract customers is called?

Answer:

- Three

- Compound entry

- Goodwill

- Trade discount.

Journal Short Answer Type Questions

Question 1.

Explain the rules of making Journal.

Answer:

For recording the transactions in the journal, the following points should be kept in mind:

- Affects two accounts – Every transaction affects two accounts. Firstly, it should find out.

- Effect on two accounts – Secondly, find out how the affected accounts are effected, i.e., which account is debited and credited.

- Apply debit and credit – After finding the debit and credit aspect of accounts, apply the rules of debit and credit to it. The rules are as follows:

(i) Personal account:

- Debit: The receiver

- Credit: The giver.

(ii) Real account:

- Debit: What comes in

- Credit: What goes out.

(iii) Nominal account:

- Debit: All expenses and losses

- Credit: All incomes, gains and profits.

![]()

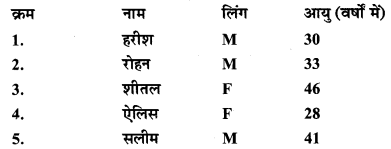

Question 2.

Give the classification of Account.

Or

Explain the types of Account.

Answer:

1. Personal Accounts:

Personal Accounts are those Accounts which are in the names of persons, firms or companies. Ex., Shubham Account, United Hospital Account, Oriental Insurance Co. Personal Account is again divided into three. It includes:

- Natural person Account

- Artificial person Account

- Representative personal Account.

2. Real Account:

Real Accounts are those accounts which relate to things or properties. Ex. Buildings, Furniture, Machinery etc. It is again divided into two. It includes:

- Tangible Real Accounts

- Intangible Real Account.

3. Nominal Account:

These are the accounts of expenses, incomes, profits or losses. Ex. Salary account, Interesi Account, Loss on Sale of goods, Profit on sale, etc:

- Rule : Debit – All Expenses or losses.

- Credit – All Incomes or gains.

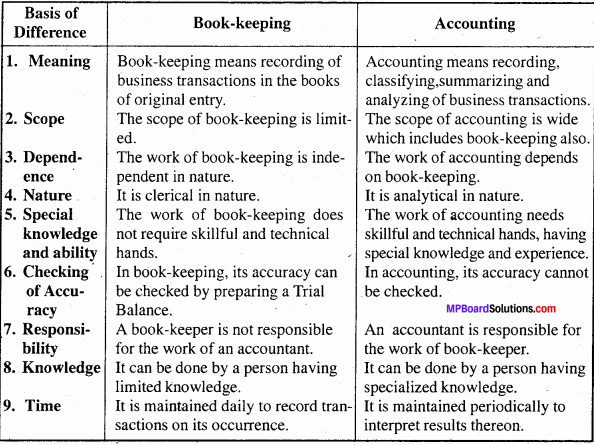

Question 3.

Trade discount is not entered in the books of accounts. Explain.

Answer:

Trade discount is included in the invoice price of a commodity and that invoice price should also be included with cost price and profit of the commodity, i.e., without bearing the risk of loss, the trader can easily sell the goods. In this way the seller also sells the goods to the customers by showing invoice price without any loss and does his service. So, either the seller or the buyer doesn’t enter trade discount in his books of accounts.

![]()

Question 4.

Describe ledger of goods account.

Answer:

Classification of goods A/c are as follows:

- Purchase A/c – Whatever goods are being purchased weather it is in cash or credit all the goods are entered in purchase A/c.

- Sales – Whatever goods are being sold cash or credit entered in sales A/c.

- Purchase return – Whatever goods are returned by trader to its supplier is entered in purchase return A/c.

- Sales returns – Whatever sold goods are returned by customer to trader is entered in sales return A/c.

- Stock – Whatever goods remains unsold during the current year is called stock and entered it in stock A/c.

Journal Long Answer Type Questions

Question 1.

Explain the need of preparing journal.

Or

Explain the importance of Journal, (any four)

Or

Explain some objectives of Journal.

Answer:

Due to the following reasons journal is made:

- For complete knowledge – It is essential to record the transactions in the journal for complete knowledge. Journal facilitates this need.

- Helps ledger accounts – Journal helps to prepare ledger accounts, i. e., The preparation of ledger accounts depends on journal.

- A short description – At the end of each journal entry a short description about the transaction, called narration is written. It gives a complete idea of transaction.

- Knowledge of daily transactions – In journal transactions are recorded daily. If it is needed to know, the transactions of a particular date, it can be obtained from the journal.

- Proof of evidence – If any dispute arises, journal helps to produce it as an evidence in the court.

MP Board Class 11 Accountancy Important Questions